Loan consolidation options streamline multiple high-interest debts into one lower-rate loan, simplifying repayment and saving money long-term. By understanding various loan types and comparing lenders based on key factors like interest rates and repayment periods, individuals can find the best fit for their financial needs and goals, including federal direct consolidation loans, private programs, and mortgage refinancing. This proactive approach enhances financial control, debt management, and cash flow freedom.

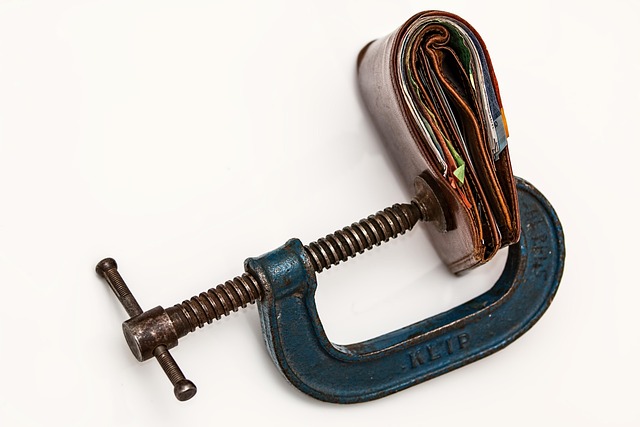

Are you looking for ways to manage your debt with lower interest rates? Exploring low-interest loan options can be a smart financial move. This article guides you through understanding these options, focusing on loan consolidation as a strategic approach to simplify repayment. We’ll cover various types of low-interest loans suitable for different needs, helping you make informed choices. Additionally, we delve into the benefits of loan consolidation options and how it can streamline your debt journey.

- Understanding Low-Interest Loan Options

- Exploring Loan Consolidation: A Strategic Move

- Choosing the Right Low-Interest Loan for Your Needs

Understanding Low-Interest Loan Options

Low-interest loan options are a wise financial choice for borrowers looking to manage debt effectively. These loans offer significant advantages over high-interest alternatives, making them an attractive proposition. Understanding your options is key when it comes to selecting the right low-interest loan consolidation plan.

Loan consolidation is a popular strategy where multiple outstanding debts are combined into a single loan with a lower interest rate. This approach simplifies repayment by reducing the number of payments you need to make each month and can save you money in the long run. Whether you’re considering federal student loans, personal loans, or home equity loans, exploring low-interest consolidation options is a proactive step towards financial well-being.

Exploring Loan Consolidation: A Strategic Move

If you have multiple loans with varying interest rates and repayment terms, exploring loan consolidation options can be a strategic move to simplify your financial obligations. Loan consolidation involves combining these loans into a single loan with a fixed interest rate and a new repayment schedule. This approach can significantly reduce your monthly payments and free up cash flow by streamlining your debt management.

By consolidating your loans, you may gain better control over your finances and make it easier to stay on track with repayments. It’s also an opportunity to extend the loan term, which can lower your overall interest expenses. Several loan consolidation options are available, including federal direct consolidation loans, private lender consolidation programs, or even refinancing through a mortgage, depending on your financial situation and goals. Each option has its own set of advantages and disadvantages, so it’s crucial to research and choose the one that best suits your needs.

Choosing the Right Low-Interest Loan for Your Needs

When exploring low-interest loan options, understanding your financial needs and goals is crucial. Different types of loans cater to various purposes, from purchasing a home or car to consolidating debt or funding education. Loan consolidation options, for instance, are ideal if you have multiple high-interest debts and want to simplify repayment with a single, lower-interest loan.

Factors like loan amount, interest rates, repayment terms, and collateral requirements vary across lenders. Comparing these aspects ensures you select the most suitable low-interest loan. Prioritize loans that align with your financial objectives, offering flexibility, manageable monthly payments, and long-term savings on interests.