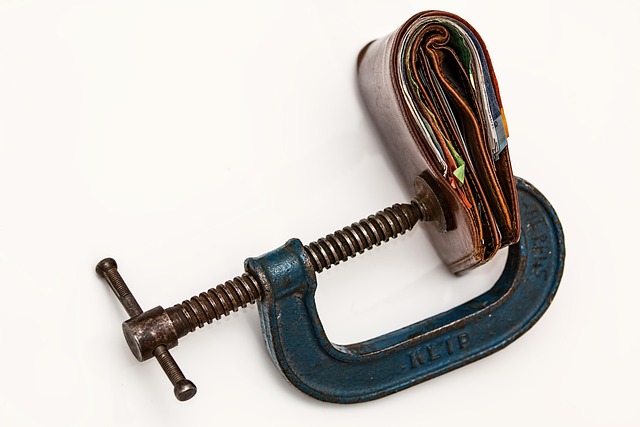

Graduates facing a complex web of private student loans struggle with financial management during crises. Loan consolidation offers a powerful solution by merging diverse debts into one with lower, fixed interest rates, streamlining repayment and saving money on interest costs over time. Options like debt settlement programs and emergency debt assistance provide tailored solutions for significant debt, enabling individuals to create effective debt reduction plans and achieve financial freedom and stability.

Struggling with multiple private student loans? Simplify your finances and reclaim control with our comprehensive guide on loan consolidation. Discover powerful tools like Loan Consolidation Options tailored for financial freedom. Learn about Direct Consolidation Loans and explore the benefits of combining private student loans. Navigate through Financial Crisis Solutions, including effective Debt Reduction Plans, emergency assistance programs, and understanding Debt Settlement Programs. Take charge today and transform your debt into a manageable path forward.

Loan Consolidation Options: Your Path to Financial Freedom

Many graduates find themselves navigating a complex financial landscape after leaving college, often burdened by multiple private student loans with varying interest rates and repayment terms. This can lead to a confusing and stressful situation, especially when managing unexpected expenses or facing a financial crisis. However, there’s a powerful tool that can simplify this challenge: Loan Consolidation Options.

Debt reduction plans like loan consolidation provide an opportunity to streamline these debts into one comprehensive loan with a single, lower interest rate. This approach offers significant benefits, including easier repayment management and the potential for saving on interest costs over time. For those struggling with emergency debt assistance, loan debt consolidation could be a game-changer, offering a clear path towards financial freedom and stability. Explore these options to uncover tailored solutions that fit your unique situation, ensuring you take control of your financial future effectively.

– Understanding Loan Consolidation

Many students graduate with multiple private student loans from different lenders, each with varying interest rates and repayment terms. This can make managing one’s finances challenging during a time when many are already facing financial uncertainty due to job prospects or unexpected life events. Loan consolidation offers a potential solution for these borrowers; it involves combining multiple loans into a single loan with a fixed rate and potentially more manageable monthly payment.

This strategy provides much-needed relief during a financial crisis, making repayment less overwhelming. There are various loan consolidation options available, such as debt settlement programs that negotiate lower interest rates or loans debt consolidation that allows borrowers to refinance their existing debts. It’s important for individuals in significant debt to explore these financial crisis solutions and create a debt reduction plan tailored to their needs. Emergency debt assistance programs may also be worth considering for those who need immediate relief.