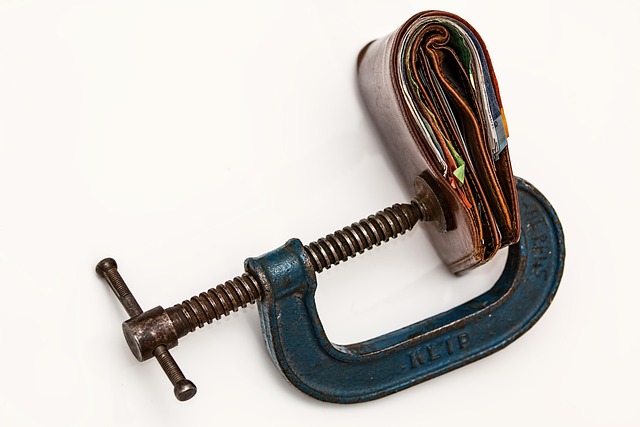

In times of multiple loan and debt struggles, understanding loan consolidation options can provide relief. Combining several loans into one reduces interest rates and simplifies repayment, offering an effective debt reduction plan. Emergency debt assistance programs like debt settlement and government-backed consolidation empower borrowers to take control of their debts and manage financial crises, providing solutions for a more stable future.

Struggling with multiple government loans? Explore powerful tools for financial freedom through seven comprehensive loan consolidation programs. From simplifying repayment with Loan Consolidation Options to crisis-specific solutions like Financial Crisis Solutions and Emergency Debt Assistance, this guide navigates the path to loans debt consolidation. Discover how to leverage Debt Reduction Plans and even negotiate with creditors via Debt Settlement Programs. Gain insights into eligibility, credit scores, application processes, and potential outcomes. Take control of your finances today!

- Understanding Loan Consolidation Options

- – Definition and benefits of loan consolidation

- – Types of loans that can be consolidated

- Financial Crisis Solutions: Exploring Debt Reduction Plans

Understanding Loan Consolidation Options

Many individuals face challenges with managing multiple loans and debts, often leading to a financial crisis. In such situations, understanding loan consolidation options becomes crucial for finding solutions. Loan consolidation involves combining several loans into one, providing relief from the burden of multiple payments. This strategic move can simplify repayment processes and significantly reduce interest rates, offering an effective debt reduction plan.

When considering loan consolidation, it’s essential to explore various programs designed to assist in emergency debt management. These programs include debt settlement options, where qualified individuals can negotiate with lenders for a reduced settlement amount, and government-backed consolidation plans that offer favorable terms and long-term savings. Exploring these financial crisis solutions can empower borrowers to take control of their debts and work towards a more stable financial future.

– Definition and benefits of loan consolidation

Loan consolidation is a strategic financial move that combines multiple debts into one single loan with a lower interest rate and potentially more favorable repayment terms. This process offers several advantages for individuals facing a multitude of loan payments, especially during challenging financial times. By consolidating loans, borrowers can simplify their financial obligations, making it easier to manage and potentially reducing the overall cost of debt.

In times of financial crisis or when dealing with emergency debt situations, exploring various loan consolidation options becomes crucial. These solutions provide a structured approach to debt reduction plans, allowing individuals to gain control over their finances. Debt settlement programs, for instance, can negotiate with lenders on behalf of borrowers, aiming to lower the overall debt burden. With the right consolidation strategy, folks can transform their financial landscape and move towards a more secure and manageable monetary future.

– Types of loans that can be consolidated

Many individuals find themselves in a financial crisis due to overwhelming debts, often comprising various types of loans. Fortunately, loan consolidation options offer a potential solution for managing and reducing this burden. These programs allow borrowers to combine multiple loans into one, simplifying repayment processes and potentially lowering interest rates. This strategic move can significantly ease the strain of debt repayments and free up cash flow, providing much-needed financial relief.

When considering loan consolidation, it’s essential to explore different Debt Reduction Plans and Emergency Debt Assistance programs tailored to specific circumstances. Some initiatives focus on negotiating with lenders for more favorable terms, while others might offer debt settlement programs that help pay off debts at a discounted rate. With various Financial Crisis Solutions available, borrowers can explore ways to consolidate student loans, credit card debts, personal loans, or even mortgage refi options, ultimately leading to better financial health and stability.

Financial Crisis Solutions: Exploring Debt Reduction Plans

In times of financial crisis, exploring effective debt reduction plans is crucial for individuals burdened by multiple debts. One powerful strategy to navigate this challenge is through loan consolidation options. These programs offer a structured approach to managing and reducing debt by combining various loans into a single, more manageable payment with potentially lower interest rates.

Many governments provide emergency debt assistance in the form of consolidation programs tailored to meet the unique needs of individuals facing financial strain. From debt settlement programs that negotiate with creditors to loans debt consolidation services that streamline repayment processes, there are several avenues to consider. Each program has its own set of eligibility criteria and benefits, ensuring individuals can find a suitable solution to take control of their financial situation and move towards a brighter future.