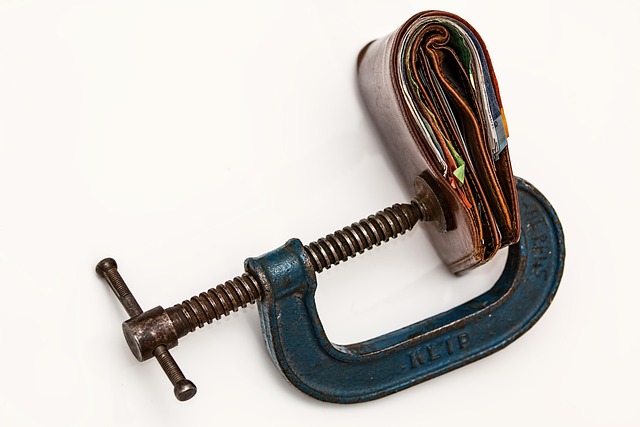

High-interest loans can quickly overwhelm individuals during crises, but loan consolidation options like debt settlement programs provide solutions. These strategies simplify repayment, reduce costs, and offer relief for those needing emergency debt assistance. By combining multiple high-interest debts into one new loan with a lower rate or negotiating lump-sum payments, borrowers can manage their financial crisis more effectively through financial crisis solutions that include debt reduction plans.

Struggling with high-interest loans? You’re not alone. This article explores practical solutions for navigating a financial crisis caused by these burdensome debts. We delve into the root causes of high-interest loans and their devastating impact on borrowers.

Discover powerful financial crisis solutions through loan consolidation options, examining methods like personal loans and home equity. Learn how this strategy offers relief compared to debt settlement programs and emergency debt assistance. Additionally, we provide effective debt reduction plans, including budgeting tips and aggressive repayment strategies, empowering you to take control of your financial future.

- Understanding High-Interest Loans and Their Impact

- – Definition of high-interest loans

- – Common types and causes of such loans

Understanding High-Interest Loans and Their Impact

High-interest loans can be a financial burden, especially during or after a financial crisis. These loans often come with steep interest rates and strict repayment terms, making it challenging for borrowers to manage their debt. When an individual takes out a high-interest loan, they risk falling into a cycle of increasing debt due to the compounding interest. This situation can be particularly problematic for those facing unexpected expenses or emergencies, as these loans are typically designed for short-term financial relief.

Loan consolidation options offer a potential solution for individuals struggling with high-interest loans. By consolidating multiple debts, including high-interest loans, into one new loan with a lower interest rate, borrowers can simplify their repayment process and reduce the overall cost of debt. This strategy is particularly effective for those with various emergency debt assistance needs or those seeking more manageable debt reduction plans. Debt settlement programs, another Financial Crisis Solutions, can also help by negotiating with lenders to forgive a portion of the debt, providing much-needed relief for borrowers overwhelmed by high-interest loan obligations.

– Definition of high-interest loans

High-interest loans are a financial burden for many individuals and families. These are borrowing options that come with significantly higher interest rates compared to traditional loans, often as a result of less favorable terms or a lack of creditworthiness on the part of the borrower. Such loans can quickly spiral out of control, leading to a cycle of debt. When someone takes out a high-interest loan during an unexpected financial crisis, it can become even more challenging to manage other debts and daily expenses.

In such situations, exploring loan consolidation options is a strategic move towards alleviating this strain. By combining multiple high-interest loans into one new loan with a lower interest rate, individuals can simplify their debt repayment process. This approach, often facilitated through debt reduction plans or emergency debt assistance programs, offers relief by decreasing monthly payments and the overall cost of borrowing. Additionally, some borrowers may explore debt settlement programs, which aim to negotiate with lenders for a lump-sum payment to settle the debt, potentially saving them money in the long run.

– Common types and causes of such loans

High-interest loans often trap individuals in a cycle of escalating debt. Common types include payday loans, credit card balances carrying high APRs, and personal loans with unfavorable terms. These loans typically target people facing unexpected financial crises or lacking adequate savings for emergencies. During times of economic hardship, such as the recent global Financial Crisis Solutions, many turn to these short-term fixes without fully understanding the consequences.

Causes often stem from insufficient budgeting, unexpected life events, or a lack of access to traditional banking services. Without proper Debt Reduction Plans or Emergency Debt Assistance, these loans can lead to prolonged financial strain. Fortunately, Loan Consolidation Options and Debt Settlement Programs exist as Financial Crisis Solutions to help borrowers break free. These strategies, including debt consolidation, offer relief by combining multiple debts, reducing interest rates, and providing a structured repayment plan, ultimately easing the burden of high-interest loans.